EthereumPoW (ETHW) Guide: The Proof-of-Work Fork of Ethereum

Key Takeaways

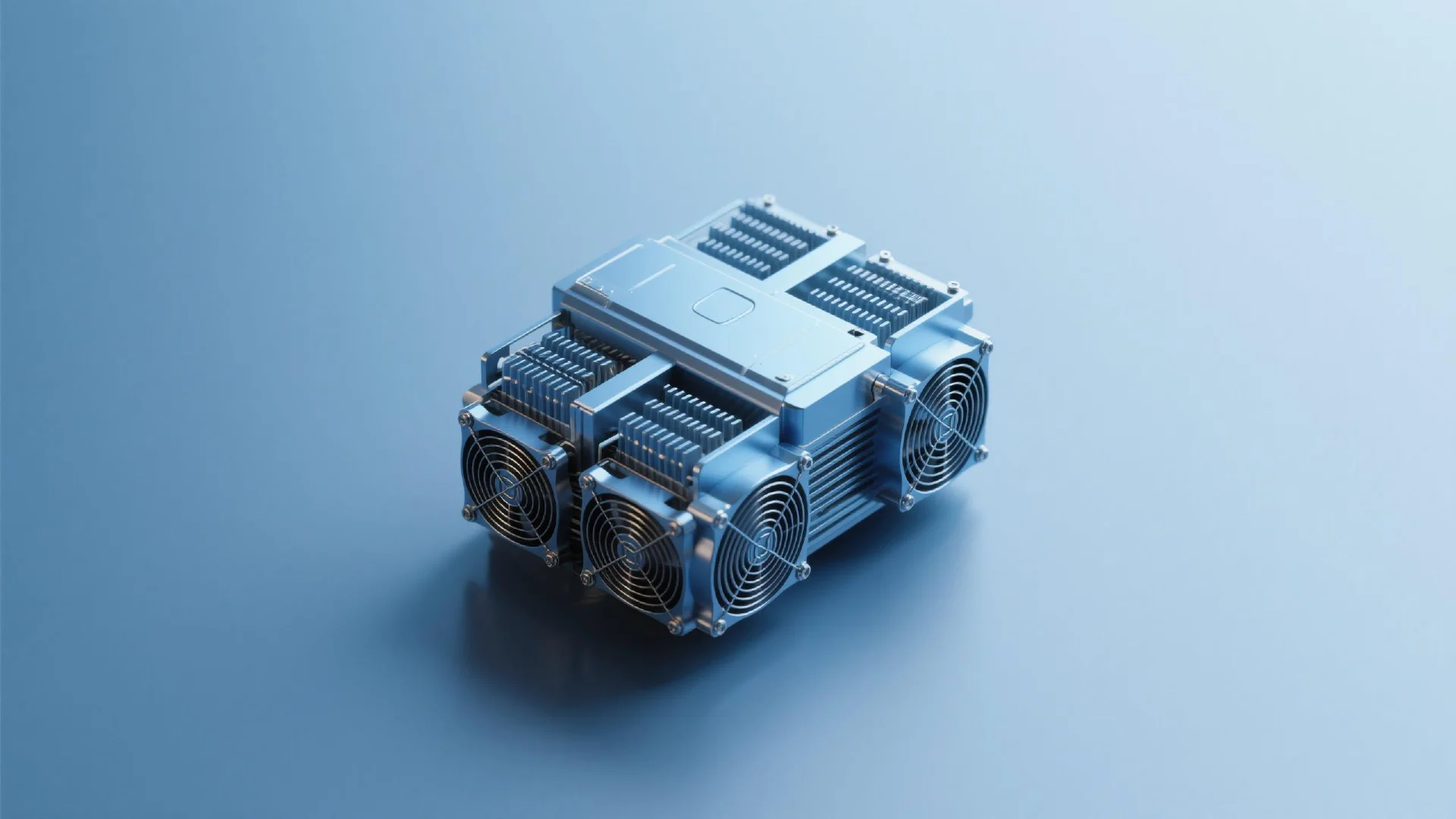

• ETHW is a proof-of-work fork of Ethereum that allows miners to continue operating post-Merge.

• It differs from Ethereum in consensus mechanism, ecosystem size, and economic security.

• Users should verify chain parameters and contract addresses to avoid scams and ensure security.

• ETHW remains a niche chain with variable liquidity and exchange support as of 2025.

• Hardware wallets like OneKey can enhance security when managing ETHW assets.

EthereumPoW (ETHW) is the largest proof-of-work fork that continued mining after Ethereum’s transition to proof-of-stake during The Merge in September 2022. This guide explains what ETHW is, how it differs from Ethereum, the current state of the network in 2025, practical steps to access the chain, and key risks to consider if you plan to use or hold ETHW.

What is EthereumPoW (ETHW)?

ETHW emerged as a community-led fork after Ethereum switched away from mining to staking in The Merge. While Ethereum now secures the network via proof-of-stake, ETHW retained proof-of-work so miners could continue operating. The fork was coordinated by a group of miners and developers, with the ETHW chain launching shortly after the Merge and distributing ETHW to addresses that held ETH at the time of the fork. Coverage of the initial launch and context is available in CoinDesk’s report on the ETHW mainnet launch.

Official project resources:

- Website: EthereumPoW

- Codebase: ETHW’s go-ethereum fork

How ETHW Differs from Ethereum

- Consensus: ETHW uses proof-of-work (mining), whereas Ethereum uses proof-of-stake (staking validators). For a background on these models, see Ethereum’s docs on consensus mechanisms.

- Replay protection: To ensure transactions on ETHW are not replayed on Ethereum, ETHW changed its chain ID and relies on EIP-155 replay protection.

- Ecosystem size: ETHW maintains EVM compatibility, but its dApp ecosystem, liquidity, and developer activity are notably smaller than Ethereum’s.

- Economics and security: Proof-of-work security depends on sustained hash rate and miner incentives. Lower usage or rewards can impact network security parameters like resistance to 51% attacks.

Network Basics

- Chain ID: Chain ID 10001 (ETHW)

- Explorer: You can check blocks, transactions, and token contracts via the ETHW explorer on OKLink.

- Node software: ETHW maintains its own builds in the go-ethereum fork. If you plan to run a node or bridge infrastructure, review releases and commit history in that repository.

ETHW in 2025: Liquidity, Hash Rate, and Availability

Three years on from The Merge, ETHW remains a niche chain with variable exchange support and limited liquidity. Before making decisions, verify current markets and trading venues via a neutral aggregator like CoinMarketCap’s market overview.

For miners and security observers, network hash rate and pool distribution are critical indicators. You can track mining participation and pool dominance on MiningPoolStats (ETHW). Lower hash rate can imply reduced economic security and higher vulnerability to chain reorganizations.

Accessing ETHW: Wallet and RPC Setup

ETHW is EVM-compatible, so most Ethereum-style wallets can connect by adding a custom network:

- Network name: EthereumPoW (ETHW)

- RPC: Use a trusted RPC endpoint (check project resources or credible providers)

- Chain ID: 10001

- Currency symbol: ETHW

- Block explorer: OKLink ETHW explorer

Best practices:

- Verify the chain ID and explorer domain before sending transactions.

- Re-confirm token contract addresses on ETHW; they are not necessarily identical to Ethereum’s.

- Never import seed phrases into web wallets; use hardware devices or offline signing wherever possible.

Claiming ETHW and Airdrops: What You Need to Know

ETHW was distributed at the time of the fork in 2022 based on Ethereum balances at the snapshot. If you held ETH in self-custody during The Merge, your corresponding ETHW would exist on the ETHW chain at the same address. If you held ETH on a centralized exchange, distribution depended on that platform’s support and policies. Because these were one-time events, always verify current eligibility and distribution status directly with your custodian or via the official EthereumPoW site. Beware of scams claiming you can “reclaim” ETHW via approvals or bridges.

Security Considerations

- Replay safety: ETHW uses EIP-155 replay protection, but be wary of signing broad token approvals or interacting with unverified contracts on unfamiliar chains.

- Economic security: Monitor hash rate and pool concentration via MiningPoolStats. Low participation can increase attack surfaces.

- Liquidity and slippage: On-chain swaps may have thin liquidity; use conservative slippage and confirm price impacts.

- Bridges and cross-chain risks: Many “bridges” are custodial. Understand custody and contract risk before moving assets across networks.

- Contract addresses: The same token symbol on ETHW may map to a different contract than on Ethereum; verify on the ETHW explorer and from project channels.

For Developers: Building on ETHW

ETHW is EVM-compatible, so typical Ethereum tooling applies with chain-specific configurations:

- Use the ETHW go-ethereum fork for node compatibility.

- Confirm RPC endpoints, gas behavior, and base fee dynamics for your dApps.

- Audit and re-verify contract addresses if porting apps from Ethereum; avoid assuming 1:1 parity.

Should You Use ETHW?

ETHW may appeal to miners, PoW proponents, and users exploring alternative EVM environments. However, the chain’s smaller ecosystem and variable support make due diligence essential. If you decide to interact with ETHW:

- Verify current markets via a neutral source like CoinMarketCap.

- Confirm chain parameters and approvals in the ETHW explorer.

- Maintain strict operational security.

OneKey and ETHW: Practical Self-Custody

If you choose to hold or test ETHW, a hardware wallet helps minimize private key exposure. OneKey supports EVM chains and custom RPC networks, enabling you to add ETHW while signing transactions offline. This setup is useful when dealing with smaller networks where phishing and contract risks can be higher. With OneKey, you can:

- Keep seed phrases in an offline device rather than in browser extensions.

- Add ETHW via custom network settings (chain ID 10001, verified RPC and explorer).

- Use WalletConnect to interact with dApps while maintaining hardware-based signing.

As with any asset on emerging or lower-liquidity chains, combine hardware-based self-custody with careful contract verification and conservative transaction practices.

Key References

- Ethereum’s transition to proof-of-stake: The Merge

- ETHW mainnet context: CoinDesk coverage of the ETHW launch

- ETHW official site: EthereumPoW

- ETHW chain ID and network basics: Chain ID 10001, ETHW explorer

- Replay protection: EIP-155

- Node and client releases: ETHW go-ethereum fork

- Hash rate and mining pools: MiningPoolStats (ETHW)

- Market data and listings: ETHW on CoinMarketCap