Is AB Token the Next Big Alpha in Crypto?

Key Takeaways

• Assess AB Token's narrative-market fit with current crypto trends.

• Evaluate the token's chain architecture and its impact on liquidity.

• Understand the importance of sustainable demand sinks in token design.

• Monitor token distribution and community engagement for credibility.

• Conduct thorough security audits and assess the team's credibility.

“Alpha” in crypto is often found at the edge of new narratives, fresh infrastructure, and underpriced risk. With Bitcoin’s post-halving cycle underway, Ethereum spot ETFs live in the U.S., and new primitives like restaking and Bitcoin Layer 2s maturing, the setup heading into 2025 is fertile for new winners. So where does AB Token fit, and what would it take for it to be the next big alpha?

This article lays out a clear framework to evaluate AB Token (or any emerging asset) across fundamentals, token design, market structure, and security — and shows you exactly where to look on-chain and in the data.

The 2024–2025 backdrop: Why new tokens can run

- Bitcoin’s fourth halving catalyzed a wave of on-chain experimentation on BTC, including the launch of the Runes protocol, which expanded non-fungible and fungible asset activity on Bitcoin’s base layer. That broadened liquidity and attention across ecosystems, especially around memecoins and experimental assets on BTC reference.

- U.S. spot Ether ETFs began trading in July 2024, institutionalizing ETH exposure and supporting broader EVM liquidity and infrastructure growth reference.

- Tokenized Treasuries and cash management products have grown rapidly, led by initiatives like BlackRock’s BUIDL fund on Ethereum, signaling real-world assets are a durable, yields-driven narrative reference.

- L2s now concentrate users and fees; tracking TVL and activity is critical to spotting traction for new apps and tokens reference. DeFi liquidity remains fragmented, but improving, with aggregate TVL data available via DeFiLlama.

- Restaking moved from theory to large-scale deployment, opening new security markets and creating cross-protocol yield. For a token plugged into this stack, the addressable market can expand quickly reference.

These currents can lift new assets — if they’re designed and distributed wisely.

The checklist: What would make AB Token a legitimate “next alpha”?

- Narrative–market fit

- Does AB Token align with a durable trend (e.g., restaking, DeFi infrastructure, modular data availability, Bitcoin L2s, DePIN, or RWAs)?

- Is there a wedge: a specific job-to-be-done where the token meaningfully improves capital efficiency, security, or user experience?

- Chain and architecture

- Which settlement layer and execution environment? Activity on popular L2s may unlock immediate users and liquidity. Cross-chain deployments should be intentional (not vanity), with clear bridging and risk models. Monitor L2 share and security assumptions via L2Beat.

- Token design and demand sinks

- Utility beyond governance: staking for protocol security, fee rebates, collateral utility, restaking hooks, or access to scarce resources (blockspace, bandwidth).

- Sustainable demand sinks: can usage create buy pressure (fees in token with burn or lock, or staking yields funded by real revenue rather than emissions)?

- Supply, unlocks, and market structure

- Total supply, initial float, and emissions schedule matter more than headline FDV. Early float too low can be reflexive up and down; too high can cap upside. Track upcoming unlocks and cliffs with independent dashboards like Token Unlocks.

- Where is liquidity concentrated (CEX vs. AMM) and how deep is it? Thin pools are vulnerable to MEV and slippage. Review pool depth and routing on DEX docs such as Uniswap.

- Distribution and community

- Was the distribution credible (e.g., airdrops to real users over sybils, fair launches, or transparent sales)?

- On-chain, monitor holder dispersion, top holder concentration, and exchange wallets. Tools like Etherscan, Dune, and Nansen can surface concentration and flow data.

- Security, audits, and operational hygiene

- Verified source code, time locks on critical parameters, well-documented upgradeability, multi-sig transparency (signers, thresholds), and at least one reputable audit (Trail of Bits, OpenZeppelin, etc.). See guidance on modern audit scope from OpenZeppelin’s security posts reference.

- Be wary of opaque proxies and admin keys without delays. Chainalysis’ crime reports chronicle how exploitable or centralized designs lead to losses at scale reference.

- Team credibility and shipping velocity

- Public repositories, shipping cadence, and credible backers/partners help. But substance beats narratives: mainnet integrations, real revenue, or verified active users should show up in on-chain metrics.

- Regulatory surface

- If AB Token has RWA exposure, compliance and custody design are central. Token mechanics that mimic dividends can change the regulatory profile; tread carefully and evaluate disclosures.

Hands-on due diligence: How to evaluate AB Token in practice

-

Verify the contract

- Confirm the official contract address from the project’s signed announcement channels and cross-check on Etherscan. Look for verified source, proxy status, and admin rights.

- Inspect Ownership/Access: Are there multi-sig addresses with clear thresholds? Are critical functions time-locked?

-

Check token distribution and early holders

-

Analyze liquidity and trading routes

- Identify main pools and routing (e.g., Uniswap V3, Curve, Base L2). Thin liquidity amplifies slippage and sandwich risk. Review DEX docs and fee tier choices via Uniswap documentation.

- Snapshot CEX depth (if listed). No or minimal spot/derivatives depth increases volatility risk.

-

Map emissions and unlocks

- Cross-check whitepaper/Docs against third-party trackers like Token Unlocks. Align the unlock calendar with your investment horizon.

-

Review audits and change history

- Confirm which code commits were audited and whether major changes shipped afterward. Reputable audit firms publicly list reports; OpenZeppelin’s audit index can be a starting point reference.

-

Test utility and integrations

- If AB Token is used for staking, fees, or collateral, try the dApp on a test wallet first. Confirm EIP-712 typed data clarity and understand any Permit flows (see EIP-2612).

- For L2 deployments, verify bridges and canonical addresses via official L2 explorers and documentation. Cross-check L2 risk assumptions on L2Beat.

What could be AB Token’s real catalysts?

- Clear product-market fit attached to a 2025 narrative: for example, a restaking-secured service with measurable revenue, or a Bitcoin-aligned asset with utility in the post-Runes ecosystem. See context on restaking’s mechanisms in Binance Research’s overview reference.

- Net-new distribution that grows real users: targeted airdrops and liquidity incentives that convert to sticky activity rather than mercenary capital.

- Integrations that matter: listings with deep liquidity, lending/collateral acceptance, or integrations into middleware that expand the token’s utility surface.

- Sustainable token economics: buy pressure tied to usage and security rather than emissions alone.

Red flags to watch

- Unclear admin controls, upgradeable proxies without time locks, or opaque multi-sig signers.

- Emissions-heavy rewards with no revenue path or demand sink.

- Extremely low initial float with aggressive marketing can produce reflexive blow-offs.

- “Audit-washed” claims: audits that don’t match deployed commit hashes.

- Sudden liquidity withdrawals, or LP tokens not locked or transparently controlled.

- Overpromising cross-chain “bridgeless” miracles without explaining security trade-offs.

Portfolio and execution considerations

- Sizing and liquidity: Adjust size to daily turnover and slippage; avoid becoming the liquidity.

- Time unlocks: If large cliffs are near, consider waiting for price discovery post-unlock.

- MEV-aware execution: Use protected order flow or RFQ venues where possible; understand sandwich risk in volatile pools. Flashbots’ materials on MEV offer useful background reference.

- Monitor data, not just price: Keep dashboards for active addresses, DAU/MAU, real revenue, staking participation, and treasury transparency via Dune and DeFiLlama.

Security first: Self-custody for new listings and airdrops

New tokens often require contract approvals, cross-chain bridges, and frequent transactions — all common vectors for exploits. Use a hardware wallet and follow least-privilege principles:

- Separate hot addresses for experimenting, cap allowances, and regularly revoke approvals via explorer tools.

- Verify contract interactions with clear signing and EIP-712 support.

- Keep long-term holdings in cold storage, and only connect to verified dApps.

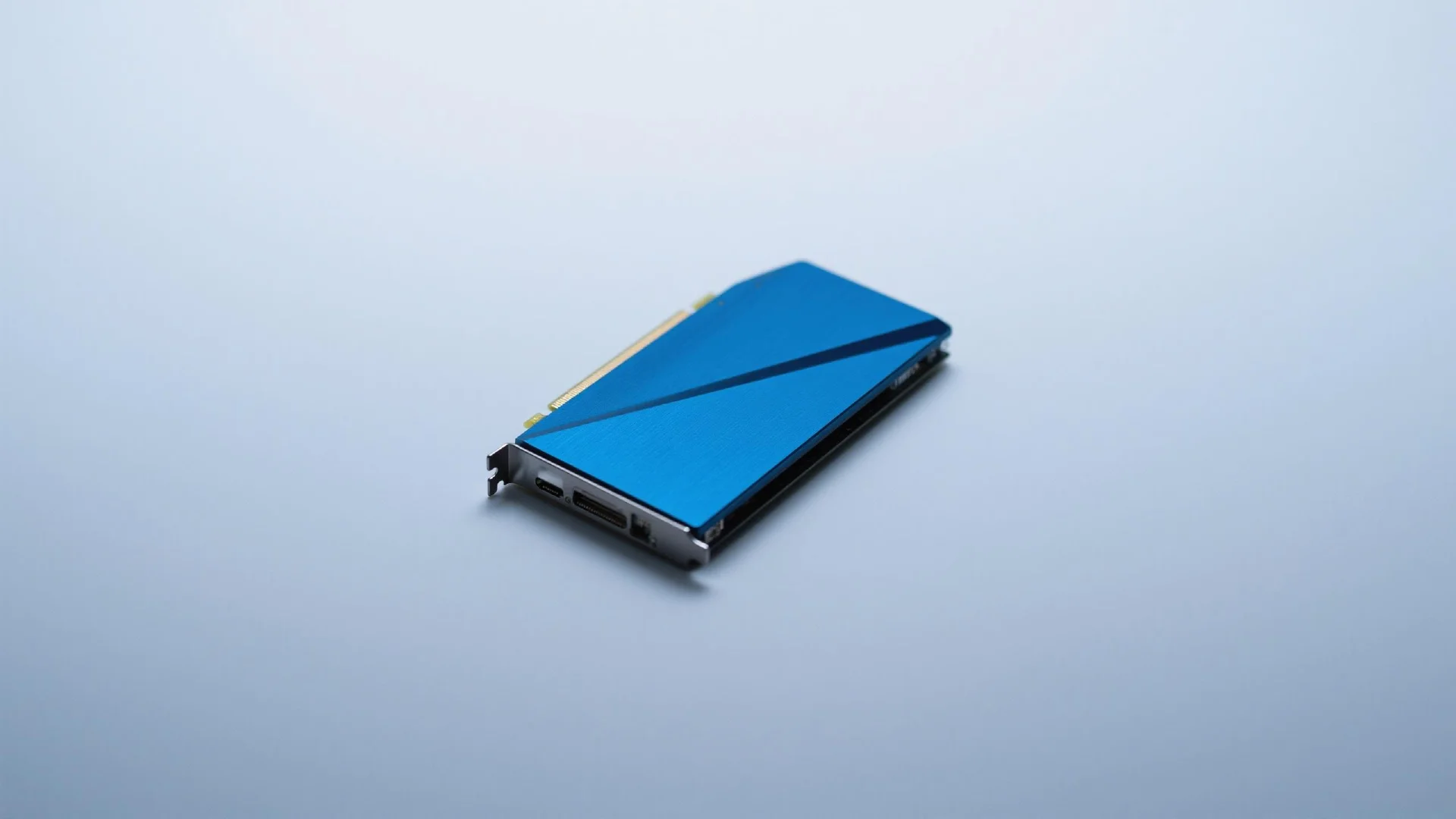

If you need a dedicated device, OneKey offers an open-source hardware wallet stack with clear signing, multi-chain support across EVM and Bitcoin, and WalletConnect integration — useful when testing new tokens while keeping funds offline. For active researchers rotating into potential “next alpha” plays like AB Token, isolating risk with a hardware wallet and using a clean signer for every new dApp can meaningfully reduce operational risk.

Bottom line

Could AB Token be the next big alpha? Maybe — if it ships real utility into a durable 2025 narrative, pairs it with sustainable token economics, and passes a rigorous on-chain and security review. Use the framework above, verify every contract and unlock schedule, and keep execution and custody tight. In crypto, the edge is often as much about process and protection as it is about picking.