What is Cloud Mining?

Key Takeaways

• Cloud mining allows users to rent computing power from remote data centers, making cryptocurrency mining more accessible.

• There are two main types of cloud mining: hosted mining and leased hash power, each offering different levels of control and risk.

• While cloud mining reduces upfront costs and technical barriers, it carries risks such as counterparty risk and profitability volatility.

• Security is crucial; using hardware wallets for storing mined cryptocurrencies is recommended to protect assets from online threats.

Cloud mining has emerged as a popular solution for individuals and institutions who want to participate in cryptocurrency mining without the complexities and costs of maintaining physical mining hardware. As the blockchain industry matures and proof-of-work (PoW) mining becomes more competitive and resource-intensive, cloud mining offers a more accessible entry point for those interested in earning cryptocurrencies like Bitcoin.

Understanding Cloud Mining

Cloud mining is a process where users rent computing power from remote data centers, operated by third-party providers, to mine cryptocurrencies. These providers own and manage the mining hardware, relieving users from the need to purchase, install, and maintain expensive mining rigs or deal with high electricity costs. Instead, users sign contracts to lease a share of the provider’s hash power and receive a proportional share of mining rewards, typically in the form of the mined cryptocurrency itself.

For a more detailed breakdown, reputable sources like Kraken provide comprehensive explanations on how cloud mining works and its role in the crypto ecosystem (Kraken: What is cloud mining?).

How Does Cloud Mining Work?

The core principle behind cloud mining is straightforward:

- Contract Agreement: Users enter into a contract with a cloud mining service provider. This contract specifies the amount of computing power (hash rate) the user is renting and the duration of the agreement.

- Operation & Maintenance: The provider takes full responsibility for operating, maintaining, and updating the mining equipment. This includes hardware setup, cooling, and electricity management.

- Rewards Distribution: The cryptocurrencies mined by the rented hash power are distributed to the user’s account, minus any applicable service or maintenance fees.

This arrangement allows broad participation in mining without the technical and financial barriers of traditional setups. As outlined by Bitpanda Academy, cloud mining serves as a “bridge for those who want to explore mining without dealing with technical challenges” (Bitpanda Academy: Cloud Mining).

Types of Cloud Mining

There are two primary models of cloud mining:

- Hosted Mining: Users lease or buy specific mining hardware hosted at the provider’s facility. The customer owns the hardware but the provider manages it entirely.

- Leased Hash Power: The most common approach, where users lease a portion of the total computational power operated by the provider. Rewards are distributed based on the amount of hash rate rented.

This distinction is important for users to understand their level of control, risk, and potential return (Changelly: What Is Cloud Mining).

Advantages of Cloud Mining

- Ease of Access: No need for advanced technical knowledge or dedicated space for mining rigs.

- Reduced Upfront Costs: Avoids the significant initial investment in hardware and ongoing maintenance.

- Energy Efficiency: Users are not responsible for high electricity bills or dealing with noise and heat.

- Scalability: Easily adjust mining capacity by changing contract sizes or providers.

Risks and Considerations

Despite its appeal, cloud mining carries several risks:

- Counterparty Risk: Users must trust providers to operate legitimately and transparently, as the sector has seen scams and fraudulent companies.

- Profitability Volatility: Mining returns depend on factors like cryptocurrency prices, mining difficulty, and service fees. Unexpected market shifts can affect profitability.

- Limited Control: Users have no physical access to the hardware and limited influence over operational decisions.

- Regulatory Uncertainty: Changes in cryptocurrency regulation can impact mining operations, especially in certain jurisdictions (Coinbase: What is cloud mining in crypto?).

It’s essential to conduct thorough due diligence before selecting a cloud mining provider. Look for transparent operations, verifiable track records, and positive community reputation.

Cloud Mining in the Current Crypto Landscape

As of 2025, cloud mining remains relevant, especially as the network difficulty and market competition for major cryptocurrencies like Bitcoin continue to intensify. The recent Bitcoin halving event has further tightened mining margins, making efficient operation and scale increasingly important. Cloud mining platforms can leverage economies of scale to remain competitive, but the risk profile requires careful provider selection and constant monitoring of contract terms (Kraken: What is cloud mining?).

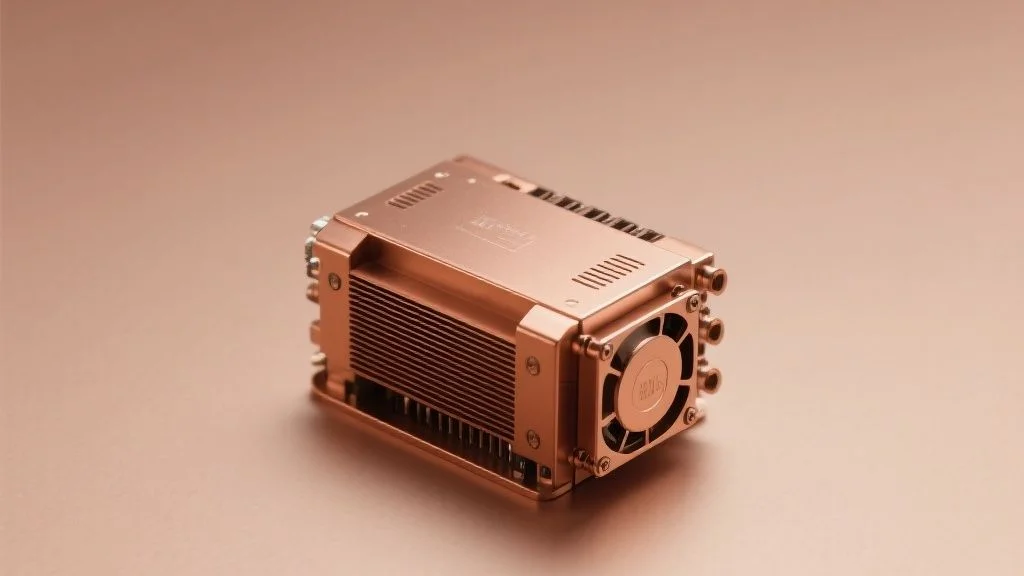

How to Secure Your Mining Rewards

While cloud mining platforms typically distribute rewards directly to user wallets, the security of those assets remains paramount. It’s highly recommended to store mined cryptocurrencies in secure, self-custody hardware wallets rather than leaving them on third-party platforms. Hardware wallets like OneKey ensure users have full control over their assets and protection from online threats or provider insolvency.

Unlike hot wallets or exchange accounts, hardware wallets store private keys offline, significantly reducing the risk of hacks or unauthorized access. For those participating in cloud mining or accumulating crypto assets, integrating a hardware wallet into your security strategy is a best practice for asset protection.

Conclusion

Cloud mining democratizes access to cryptocurrency mining, making it feasible for a wider audience while removing technical and logistical barriers. However, it is crucial to weigh the convenience and accessibility against the inherent risks and volatility of the sector. For anyone considering cloud mining, prioritizing security through reliable storage solutions, such as the OneKey hardware wallet, is a prudent step to safeguard your digital assets.

For further insights on cloud mining, visit educational resources like Bitpanda Academy’s cloud mining guide and updates from Changelly’s cloud mining overview. Always stay informed and vigilant when navigating the rapidly evolving world of cryptocurrency and blockchain.