Which On-Chain Yields Are Higher?: The Game of Risk and Reward

Key Takeaways

• CEX vs DeFi Resilience — centralized exchanges suffered mass liquidations; DeFi protocols maintained transparency and order.

• Midas Pools (mHYPER / mFONE / mSYRUPUSDP) — 30%+ yields from layered strategies; requires close attention to asset composition and management risk.

• USDAI (RWA + AI Hybrid Stablecoin) — yield sources split between T-bills and AI loans, but Pendle yields come mainly from airdrop/point speculation.

• Avantis USDC Pool — GLP-style liquidity model; LPs earn trading fees but bear directional risk when traders win.

• SLISBNB (ListaDAO) — dual-source yield from staking and Binance Launch Pool rewards (~10%); consider 7-day unbonding and BNB price exposure.

The market crash has once again put centralized exchanges at the center of public opinion. In the "largest liquidation night in history," tens of billions of dollars in positions were forcibly closed, some were liquidated, some were margin-called, and some were advocating for “transparency.”

Meanwhile, the on-chain world remained remarkably calm. Protocols like Aave and Morpho remained composed amidst violent fluctuations—no shutdowns, no pauses, no "special treatment," everything operated according to smart contract rules.

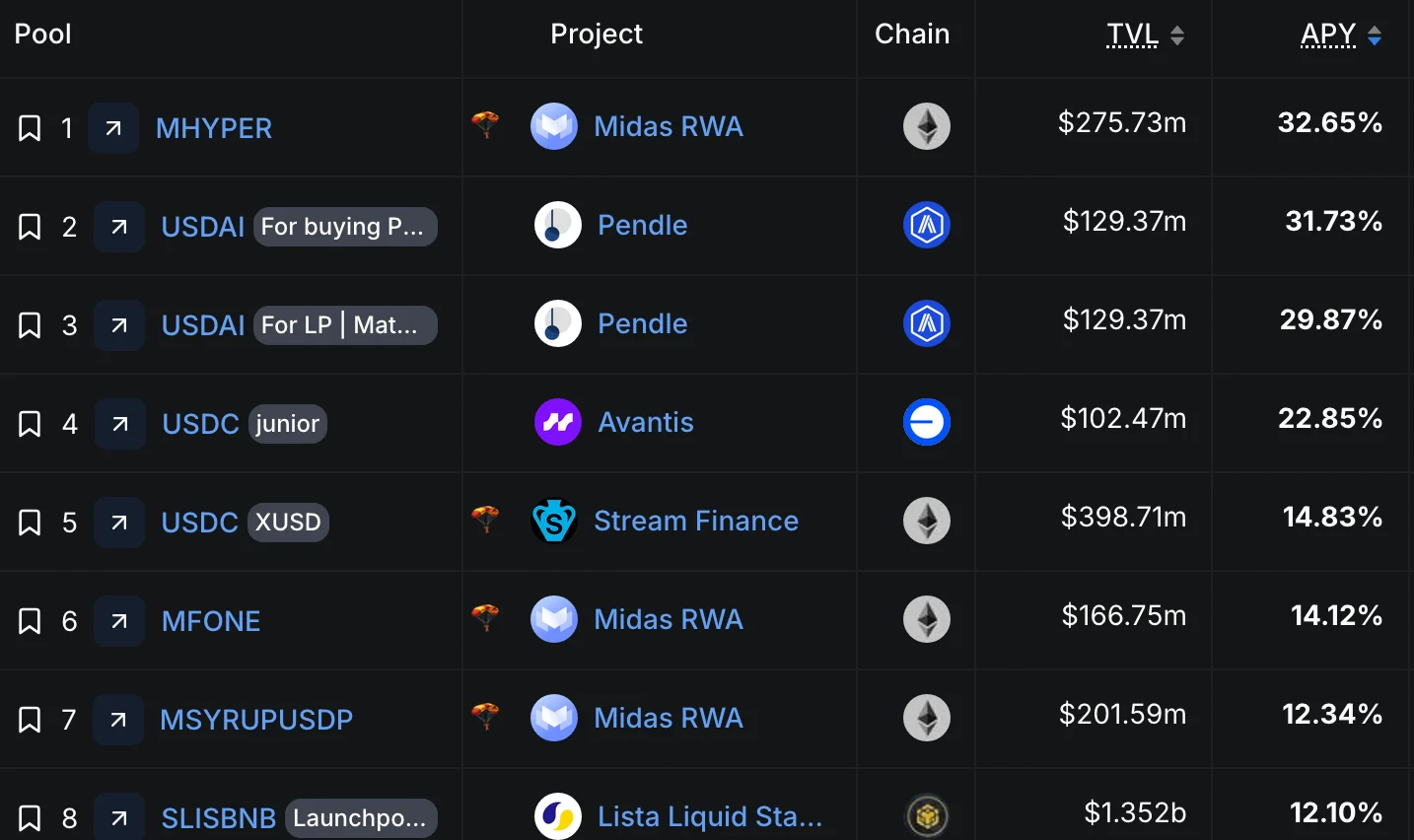

Perhaps this is a lesson we need to relearn: to understand on-chain order and the true relationship between risk and reward. To this end, we selected major liquidity pools with TVL exceeding 100 million USD from DefiLlama and observed representative high-yield pools. We are not looking for higher returns, but rather hoping to understand the various modes of on-chain capital operation, how protocols design returns, allocate risks, and maintain balance in an open system.

After all, after experiencing such a liquidation night, understanding a bit more about the mechanisms might lead to less panic.

Pools: MHYPER & MFONE & MSYRUPUSDP

Midas (@MidasRWA) is a protocol specializing in asset tokenization. It created a type of asset called "Liquid Yield Tokens," encapsulating various assets. However, for now, you can also understand it as a protocol that issues various stablecoins.

How are stablecoins minted? Let's take mHYPER as an example:

Midas does not directly manage these assets; it just developed an issuance model. mHYPER is a stablecoin jointly issued by Midas and Hyperithm, a crypto asset management company. Hyperithm is the party actively managing user assets. Users deposit stablecoin assets like USDC and USDT into the protocol and receive mHYPER.

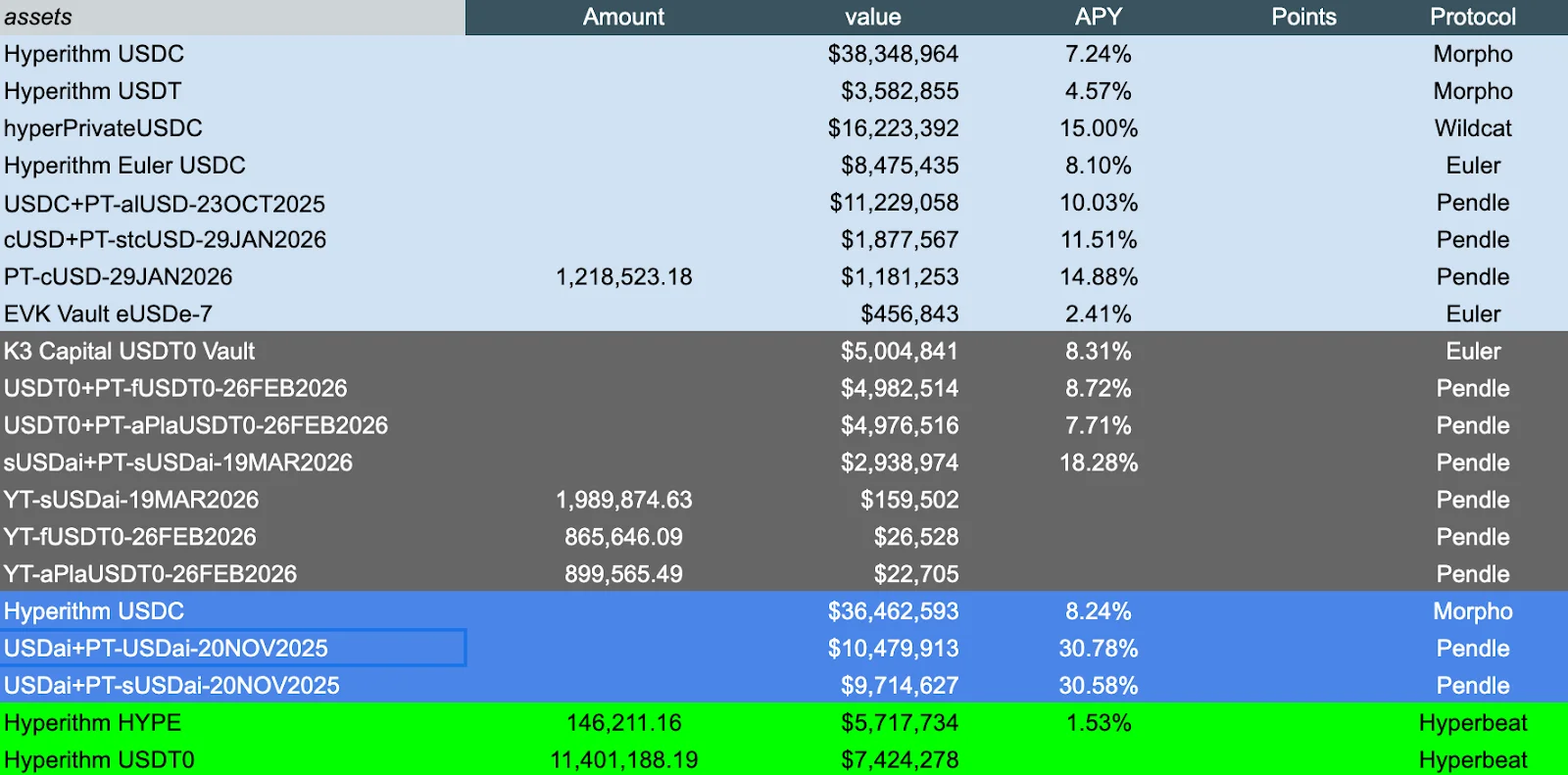

The stablecoins deposited by users will be used by this asset management party for yield strategies in various DeFi protocols. Users will receive rewards from these DeFi strategies and can use mHYPER to participate in DeFi protocols, while the asset management party and protocol party take a commission in between.

The yield for mHYPER in the chart is shown as over 30%. Experienced players can immediately tell that there must be some "peculiar" yields hidden within. Indeed, from the structural table of Midas ambassadors, we can see that behind the small mHYPER are so many assets and strategies. This is what users truly need to pay attention to.

When we decide to invest in a composite asset, "peeking" into the corresponding yields and risks of its underlying assets is something we must do. Ask yourself repeatedly: "Is this the asset I want to have exposure to? What are these yields from? Are they USD? Or future tokens? Can I withdraw at any time? Will I be charged for withdrawal?..." Learn with questions, but never deposit funds with questions.

The logic is similar for MFONE and MSYRUPUSDP, but there are differences in various details such as fund managers, strategies, and fee structures.

For example, MFONE's underlying assets include a large number of off-chain assets, which we call "RWA," while MSYRUPUSDP is a "Pre-Deposit" pool on Plasma, used to mine XPL.

Pool: USDAI

First, what is USDAI? A new stablecoin protocol with a luxurious investment lineup. Like 99% of stablecoins, users can deposit USDC and mint USDAI. A portion of the user's funds will be used to purchase short-term US Treasury bonds, and another portion will be lent to AI companies to purchase computing power infrastructure. This is why it's called USDAI.

Yields come partly from Treasury bills and partly from the interest paid by these AI companies. Sounds very advanced? Does a 30% excess yield mean AI companies are paying huge interest?

Let's go back to Pendle. Currently, the two yield venues for USDAI are actually USDAI pools on Pendle. We are already very familiar with Pendle, which separates interest-bearing tokens into PT (principal) and YT (future yield), allowing both conservative and aggressive investors in the market to get what they want.

Taking USDAI as an example, Pendle allows this asset, USDAI, and its future potential yield to be divided into PT and YT. Buying 1 PT is like buying 1 USDAI at a discount, while buying 1 YT is buying the future yield corresponding to 1 USDAI. The current yield rate is the price of YT, which is the expected yield rate of USDAI; correspondingly, buying PT means locking in this yield rate now and earning a certain amount of money.

Where does the yield actually come from? Pendle clearly states, "1 YT USDai (USDai) gives the points of 1 USDai until maturity," meaning the yield is purely points. So, such high yields are actually due to people's optimism about future USDAI airdrop expectations.

Where did my Treasury bill yield go? Sorry, USDAI holders do not receive this portion of the yield; they need to stake USDAI as sUSDAI to receive this portion of the yield.

Every participant should consider where their yield comes from and whether they can actually get it. For example, buying YT is buying future points, not interest earned from lending to AI companies. Therefore, you should fully consider the future token value of USDAI and its token distribution rules, and participate cautiously.

Pool: Avantis's USDC

Avantis is currently the leading perpetual DEX on Base. This USDC pool is crucial for its operation. It is also a liquidity provision method similar to the GLP model.

Users deposit USDC into the LP pool to act as the counterparty for traders. If traders are generally profitable, it can be seen that traders are taking profits from this pool, and if traders are generally losing money, the lost money will also be put into this liquidity pool, but it will not be distributed as profit to LPs, but rather act as a buffer. LPs only earn trading fees.

The yield is clear: transaction fees. So why is the annualized yield of this pool so high? Two reasons: a large amount of trading fees have been generated recently, plus 100% of the fees go to LPs.

What about the risk? LPs are betting on one thing: can the transaction fees earned cover the money traders make from the pool? If you understand this, you will know whether you want to participate.

Pool: SLISBNB

SLISBNB is a liquid-staked BNB issued by Lista DAO. Not only that, Lista DAO is a CDP protocol on the BNB Chain, where users can collateralize corresponding assets to mint stablecoins for use in various protocols to earn yields.

You might think: why can simple liquid staking bring such high yields? The answer is, of course, it cannot. But the charm of SLISBNB is that you can use it to participate in Binance's Launch Pool, which is where the big rewards come from. Simply put, if you hold SLISBNB in your Binance wallet, it is equivalent to using BNB in the exchange to participate in Launch Pool.

Therefore, the high yield of SLISBNB is actually divided into two parts: one part is staking yield, which is a meager less than 1%, but the Launch Pool rewards can be as high as 10%, which makes SLISBNB a top-tier asset.

Of course, there are still risks. Due to the characteristics of the BNB Chain, liquid staking requires 7 days to unbond, so the price fluctuation of BNB is something you need to consider.

End

In the on-chain world, rules are public. Most people only see numbers, but ignore the mechanisms.

Yields change, narratives shift,

Only those who understand the underlying logic can stay clear-headed through the cycles.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. DeFi protocols carry significant market and technical risks. Token prices and yields are highly volatile, and participating in DeFi may result in the loss of all invested capital. Always do your own research, understand the legal requirements in your jurisdiction, and evaluate risks carefully before getting involved.